5 Special Benefits On Home Loans For Women In India

In Indian society, the role of women has eventually started to change with them becoming more career-oriented. Working women are now interested in buying assets out of their savings. Their involvement in financial investments was rare earlier, and men always had a stronghold in this department of responsibility.

With several options available to invest in, real estate remains a crucial sector where people have always shown faith. The Indian government, on the other hand, has introduced beneficial policies with a focus on women empowerment.

Hence, women in India have legit reasons to indulge in property buying and make the maximum use of home loan benefits. To understand the various types of benefits home loan offer to women, read the points below:

1. Lower Interest Rates, Better Deals

Women will always get a better deal because of lower interest rates. They are found to be more disciplined when it comes to repayment of loans. Therefore, banks are happy to offer home loans to women with lower interest rates. In addition, some lending institutions offer a special concession.

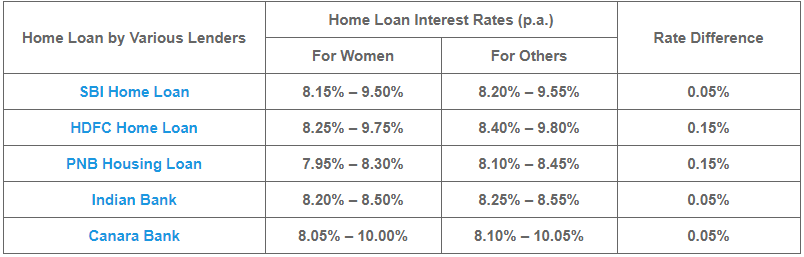

The interest rate difference in the table below might not be highly impressive, but the overall reduction in monthly interest payment will be a significant one. Find out the latest interest rates provided by the country’s reputed banks and make a comparison between women and others.

Resultantly, the amount saved due to the lower interest rates can help women meet their other requirements

.

2. With Longer Repayment Tenors, Feel No Financial Pressure

Similar to lower interest rates letting women save some money, the facility of longer repayment tenors too allows them to invest in other things by utilising the saved money. Women can repay the home loan amount within a tenor of up to 25 years. It reduces the financial pressure and lowers the EMIs.

3. The Stamp Duty Is Lower As Well For Women

During the time of property registration, another amount required to be paid is known as stamp duty. It is a tax paid to the government. Once the amount is paid, the property documents get stamped and legalised. Different states have different stamp duty amounts in India. However, every state charges less stamp duty if the house is registered in the name of a woman. It could be 1% to 2% lower than what is usually charged to the properties named under male counterparts.

4. PMAY Scheme Has Resulted In More Women Applying For A Home Loan

Although the central government scheme of Pradhan Mantri Awas Yojana (PMAY) is provided to all, women do get more preference. Reports suggest that the scheme has resulted in a 6% rise in the number of women applying for a home loan. PMAY gives an interest subsidy up to ₹ 2.67 Lacs in the home loan.

5. Eligibility Criteria For Women Who Apply For A Home Loan Is Simple

Buying a home can be a pleasant experience for women in India. With eligibility criteria made simple by the banks, women can apply for a home loan with high amounts. Besides being an Indian citizen, many banking institutions start allowing home loans from the age of 21 with a few years of work experience.

Also Read: Best Banks to get Home Loan in 2022

Recent Articles

View All