Table of Content:

- Factors Affecting Stamp Duty In Tamil Nadu

- Calculation of Stamp Duty In Tamil Nadu

- Factors Affecting Registration Charges In Tamil Nadu

- Documents Required To Pay Stamp Duty And Registration Charges In Tamil Nadu 2023

- How To Pay Stamp Duty In Tamil Nadu Online?

- How To Pay Stamp Duty In Tamil Nadu Offline?

- Stamp Duty And Land Registration Fees In Tamil Nadu

- Tax Benefits of Paying Stamp Duty In Tamil Nadu

As per the Tamil Nadu Stamp Act, 2019, and the Indian Stamps Act, 1899, a property buyer in Tamil Nadu is liable to pay stamp duty and registration charges in Tamil Nadu at the time of property registration.

For your understanding, the stamp duty in Tamil Nadu is a fee that is paid to the authorities for property registration. To undertake the paperwork to execute the process, you have to pay registration charges in Tamil Nadu.

So if you are planning to buy a property in Tamil Nadu, this informative blog on registration charges and stamp duty in Tamil Nadu will come in handy. You will be introduced to the factors affecting stamp duty, registration charges, documents required, and much more.

Recent Updates: Registration Charges & Stamp Duty In Tamil Nadu

Under Section 78 of the Registration Act, 1908, the registration fee and stamp duty charges in Tamil Nadu have increased for 20 services.

Factors Affecting Stamp Duty In Tamil Nadu

Stamp duty in Tamil Nadu is affected by the following factors:

Property Value

Number of floors

Property type

Property location

Intent of usage

Property age

Calculation of Stamp Duty In Tamil Nadu

The Tamil Nadu government determines stamp duty in Tamil Nadu. It is calculated based on the circle rate (also known as guideline value in Tamil Nadu) or consideration value of property, which one is higher.

Stamp duty in Tamil Nadu is a percentage of the transaction value of the property. According to the Tamil Nadu Stamp Act 2019, stamp duty is compulsory only for some deeds. The stamp duty in Tamil Nadu is paid at the time of property partition, sale, resale, and lease.

Interesting Read: TNRERA Tamil Nadu: Rules, Regulations & Documents

Factors Affecting Registration Charges In Tamil Nadu

Land registration charges in Tamil Nadu are affected by many factors, one of them being the type of property purchased.

If the property purchased is a part of multi-story land, then the land registration fees in Tamil Nadu are calculated based on the super built-up area.

On buying an independent property, Tamil Nadu land registration charges are calculated based on the total constructed area.

Stamp Duty And Registration Charges In Tamil Nadu 2023 for Various Documents

Stamp duty and registration charges in Tamil Nadu vary from document to document. As per the registration department of Tamil Nadu, here are the stamp duty and registration charges for various documents:

| Document | Stamp Duty | Registration Charges |

Gift | 5% of property’s market value | 2% on the property’s market value |

Exchange | 5% on the market value of the greater value property | 2% on the market value of the greater value property |

Conveyance/ Sale | 5% of the market | 4% of market value |

Simple Mortgage | 1% on the loan amount that is subjected to a maximum of Rs 40,000 | 1% on the loan amount that is subjected to a maximum of Rs 10,000 |

Mortgage with possession | 4% on the loan amount | 1% on the loan amount that is subjected to a maximum of Rs 2,00,000 |

Sale Agreement | Rs 20 | 1% on the Advance money (If possession is given, than 1% on the total amount is considered) |

Agreement relating to building construction | 1% of the value of construction/the consideration specified in the agreement, whichever is higher | 1% of the value of construction/the consideration specified in the agreement, whichever is higher |

Cancellation | Rs 50 | Rs 50 |

Partition among family members | 1% of the market value subject to a maximum of Rs 25,000 for each share | 1% subject to a maximum of Rs 4,000 for each share |

Non-family members partition | For separated shares, around 4% of the market value of the property is considered | For separated shares, 1% of the market value of the property is considered |

General Power of Attorney to sell property which is immovable | Rs 100 | Rs 10,000 |

General Power of Attorney to sell property which is immovable | Rs 100 | Rs 1,000 |

General Power of Attorney to sell a movable property for other purposes | Rs 100 | Rs 50 |

General POA given for consideration | 4% on consideration | 1% on consideration or Rs 10,000, whichever is higher |

Partnership deed (capital is within Rs 500) | Rs 50 | 1% of the capital invested |

Partnership deed in other cases | Rs 300 | 1% of the capital invested |

Moreover, the Memorandum of Deposit, MOD, registration charges in Tamil Nadu is 1% on the loan amount, with a maximum limit of Rs. 6,000/-.

Documents Required To Pay Stamp Duty And Registration Charges In Tamil Nadu 2023

The property buyer needs to have the following documents to pay land registration fees and stamp duty in Tamil Nadu:

Sale Deed

Title Deed

No Objection certificate

Encumbrance certificate

Property tax receipts

PAN card

ID Proof

Passport size photos

How To Pay Stamp Duty In Tamil Nadu Online?

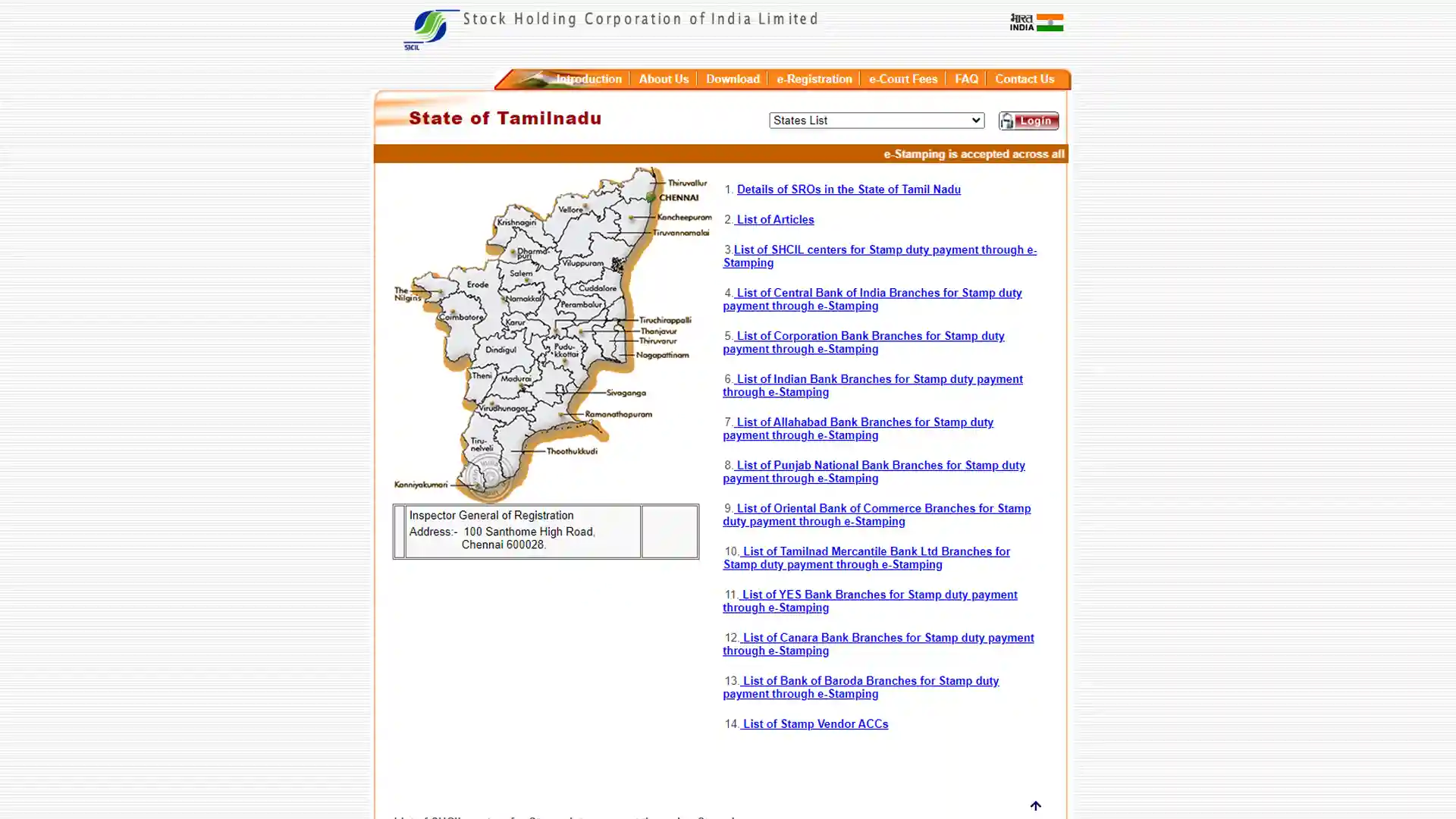

Property buyers can pay the stamp duty in Tamil Nadu online through the e-stamping facility of the Stock Holding Corporation of India Limited (SHCIL). Follow the step-by-step guide below for online payment of the stamp duty in Tamil Nadu.

Step 1: Go to the official website of SHCIL at http://www.shcilestamp.com/.

Step 2: Click on the e-stamp services

Step 3: From the drop-down, choose Tamil Nadu

Step 4: Fill out the application form and download it using the “Download” tab option.

Step 5: Take this form to the nearest branch of the SHCIL.

Step 6: At the branch, pay using any payment method: NEFT/RTGS/Cheque/Cash/Demand Draft/ Account-to-account transfer.

Also Read: Patta Chitta: Tamil Nadu Land Records Online

How To Pay Stamp Duty In Tamil Nadu Offline?

In addition to the online payment of the stamp duty in Tamil Nadu, property buyers can pay stamp duty offline. To pay the stamp duty offline in Tamil Nadu, follow the below-mentioned procedure:

Step 1: Visit the office of the sub-registrar in your city.

Step 2: Fill out the application form.

Step 3: Pay using cash/cheque/demand draft/NEFT/RTGS/Credit/Debit card to get your stamp duty certificate.

Stamp Duty And Land Registration Fees In Tamil Nadu

Unlike other states like Delhi, women property buyers get no concession on stamp duty and land registration fees in Tamil Nadu. Simply put, the stamp duty and registration charges are the same for women, men, and joint owners

Tax Benefits of Paying Stamp Duty In Tamil Nadu

Tamil Nadu land registration charges and stamp duty are an additional financial burden for property buyers. To provide financial relief, the Government of Tamil Nadu has mandated that Rs 1,50,000 be the maximum tax levied on registration charges and stamp duty payment. Hindu Undivided families and individuals can claim this tax benefit.

Also Read: Stamp Duty and Registration Charges in Chennai

Conclusion

For your information, stamp duty and land registration charges in Tamil Nadu are among the highest compared to other Indian states. Stamp duty charges and registration charges are 7% and 4%, respectively. Property buyers can pay registration charges and stamp duty in Tamil Nadu using online and offline modes.